Tuesday, May 02, 2006

The Truth about Rising Gas Prices

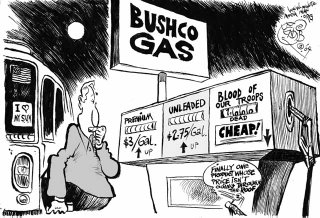

Last week I posted on the rising oil prices, and received a sharp rebuke from a conservative who believed that knee-jerk reactions like mine would further exacerbate the problem. So I decided to do more research into the issue of rising gas prices, and to try to determine if we are seeing true market balancing long overdue in the oil industry, or if we were witnessing the effects of government favoritism to the oil industry.

Last week I posted on the rising oil prices, and received a sharp rebuke from a conservative who believed that knee-jerk reactions like mine would further exacerbate the problem. So I decided to do more research into the issue of rising gas prices, and to try to determine if we are seeing true market balancing long overdue in the oil industry, or if we were witnessing the effects of government favoritism to the oil industry.

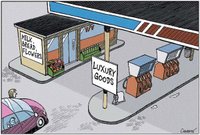

The answer, as I’m sure will be no surprise to readers of this site, will lie somewhere in the middle of the two views. We will see that, yes, these market fluctuations were well overdue, and that in some ways the rising price of a gallon of gas should be expected and even welcomed.

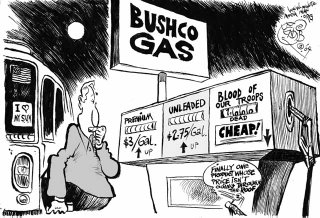

But we’ll also see that these marked price increases have been greater as a result of greater collusion with the major players in the oil industry, and that had anti-trust legislation been practiced against big-oil in the past 5 years, we would be facing much lower prices today.

Finally, we will see that, indeed, some policies that could be used to reduce the relative or actual price of a gallon of gas could serve to further increase gas prices in the long run. But we will also see that some government regulation is either necessary now or will be necessary soon to prevent the collapse of many small businesses, and economic ruin for some individuals and families.

The Price Makeup of a Gallon of Gas

Let’s start by determining the various costs that go into determining the price of a gallon of gas. I found an excellent piece on this topic from ABC News that was published on April 15th, when gas was a meager $2.68 a gallon, so all these costs should be increased by about 17% to compensate for today’s prices at the pump. But we will still get an excellent idea of the how the price of a gallon of gas is determined.

Let’s start by determining the various costs that go into determining the price of a gallon of gas. I found an excellent piece on this topic from ABC News that was published on April 15th, when gas was a meager $2.68 a gallon, so all these costs should be increased by about 17% to compensate for today’s prices at the pump. But we will still get an excellent idea of the how the price of a gallon of gas is determined.

The example is taken from an area with low gas taxes. Of the $2.68 for a gallon of gas:

- $1.45 comes from the price of a gallon of crude oil and the markup on it

- $.55 is attributed to oil refinement, the largest jump in price over the past year, and associated markup

- Transportation only costs $.05 a gallon (though I’m sure that’s rising with rising gas prices)

- Taxes account for $.45 in the low-tax area

- $.18 is unaccounted for in this model

Right away, this refutes the notion that the gas tax is a major portion of the cost of a gallon of gas, or that repealing the gas tax will provide any real relief to consumers. We also see that the real rise in the price of a gallon of gas comes from the price of crude and the cost of refinement, as well as the markups on both these items.

Increased Markup

I’m sure the first question everyone asks is how much is the markup? Of course we all just saw reports of record profits from oil companies, including an $8B quarterly profit from Exxon-Mobil. Is this a clear sign of price gauging by big oil? Well, not necessarily.

The markup on a gallon of gasoline has definitely risen substantially over the past year; the report just cited indicates that the markup for a gallon of gas has jumped from $.80 to $1.40 per gallon over the past year and a half (pre-Katrina prices). Outrageous, right? Well hold on a second.

The rise in markup is a 75% rise over this time, which happens to just about correlate with the 66-75% rise in gas prices over the same time. From this, we can deduce (meaning this is my opinion and theory, not fact, so criticize away) that while the markup has risen substantially, the profit margin has stayed about the same.

The rise in markup is a 75% rise over this time, which happens to just about correlate with the 66-75% rise in gas prices over the same time. From this, we can deduce (meaning this is my opinion and theory, not fact, so criticize away) that while the markup has risen substantially, the profit margin has stayed about the same.

Don’t understand what I’m driving at? Well, think of it this way. We are all looking at how much big oil makes on a gallon of gas. Instead, think of how much big oil makes on a dollar’s worth of product. They should still be making about the same amount on a dollar’s worth of product that they did before Katrina.

Most companies determine their success by analyzing profit margin, leading to questions of being overcritical of the oil companies. However, profit margins are kept reasonable by the existence of a competitive market forcing companies to maintain lower margins. In a competitive market, one could reasonably expect the oil companies to focus on net profit in order to maintain a competitive price and retain customers. That did not happen here.

A competitive market, and the shift to net profits, would lower gas prices, but there are questions as to how substantial the price decreases would be. We will analyze the lack of competition in the oil marketplace and how that has affected price in a later post in this series. In the interim, I believe that gas prices would drop about $.30 to $.40 in a competitive market, and while that’s welcomed relief, it’s also a drop in the bucket.

Is the Markup the Main Reason for Inflated Prices?

As determined in the past paragraph, I see a definite correlation between the price of a gallon of gas and its markup. But is this the only reason gas prices are so high? A great article in Breitbart breaks down the influences that have created the inflated prices we see today. The article brings up four important reasons why gas prices are so high:

- Global demand for oil has increased dramatically, to 85 million barrels per day, and production capacity is near its limits

- Oil traders are nervous that tensions between the United States and the Middle East, as well as other international conflicts, could lead to drastic changes in the oil market

- With the global economy expanding, there should be even more demand for oil in a short time

- Speculative investors are jumping feet first into the oil market in order to profit from inflated prices, further inflating those prices

An additional reason alluded to is that new environmental laws by the United States required a more intensive refinement process, which slows down the production of oil, lowering supply and increasing prices. President Bush has temporarily eliminated these environmentally based restrictions in an effort to reduce gas prices, but the positive effect on prices may be far lower than the negative effect on the environment.

An additional reason alluded to is that new environmental laws by the United States required a more intensive refinement process, which slows down the production of oil, lowering supply and increasing prices. President Bush has temporarily eliminated these environmentally based restrictions in an effort to reduce gas prices, but the positive effect on prices may be far lower than the negative effect on the environment.

We also cannot discount the roll that our own foreign policy has had on the price of gasoline. Only a week ago a report came out of Qatar that oil prices would drop about $15 for a barrel of crude if politicians would cease their efforts to create fear in the oil markets. The relation is that Qatar has committed over $5B to increasing oil production capacity, but is unwilling to invest that money in this political climate.

Next Steps

Over the next few days, I’m going to focus in or some of the factors that have led to the situation we face today, such as the lack of market adjustments over the past 20+ years, lack of competition in the oil industry. Plus, we’ll look closely at the effects that increased oil prices are having on citizens and small businesses.

We’ll look at the price of gasoline around the world, and identify what that tells us about the state of our own gasoline prices. We’ll look at the positive effects of increased oil prices. And we’ll finish with an evaluation of what President Bush has done and should do to deal with this growing national concern.

Finally, I will try to incorporate some of the better opinions I have found in the blogosphere into the argument, and gauge the voice of the citizenry versus the realities of the crisis. I hope this will lead us all towards a better understanding of rising gas prices, and what we face in the days, weeks, months, and years to come.

technorati tags: Gas, Oil, Price, Rising, Gallon, Bush, Administration, Markup, Inflated, Inflation

Posted by Scottage at 11:48 AM /

| |

Last week I posted on the rising oil prices, and received a sharp rebuke from a conservative who believed that knee-jerk reactions like mine would further exacerbate the problem. So I decided to do more research into the issue of rising gas prices, and to try to determine if we are seeing true market balancing long overdue in the oil industry, or if we were witnessing the effects of government favoritism to the oil industry.

Last week I posted on the rising oil prices, and received a sharp rebuke from a conservative who believed that knee-jerk reactions like mine would further exacerbate the problem. So I decided to do more research into the issue of rising gas prices, and to try to determine if we are seeing true market balancing long overdue in the oil industry, or if we were witnessing the effects of government favoritism to the oil industry. Let’s start by determining the various costs that go into determining the price of a gallon of gas. I found an excellent piece on this topic from ABC News that was published on April 15th, when gas was a meager $2.68 a gallon, so all these costs should be increased by about 17% to compensate for today’s prices at the pump. But we will still get an excellent idea of the how the price of a gallon of gas is determined.

Let’s start by determining the various costs that go into determining the price of a gallon of gas. I found an excellent piece on this topic from ABC News that was published on April 15th, when gas was a meager $2.68 a gallon, so all these costs should be increased by about 17% to compensate for today’s prices at the pump. But we will still get an excellent idea of the how the price of a gallon of gas is determined. The rise in markup is a 75% rise over this time, which happens to just about correlate with the 66-75% rise in gas prices over the same time. From this, we can deduce (meaning this is my opinion and theory, not fact, so criticize away) that while the markup has risen substantially, the profit margin has stayed about the same.

The rise in markup is a 75% rise over this time, which happens to just about correlate with the 66-75% rise in gas prices over the same time. From this, we can deduce (meaning this is my opinion and theory, not fact, so criticize away) that while the markup has risen substantially, the profit margin has stayed about the same. An additional reason alluded to is that new environmental laws by the United States required a more intensive refinement process, which slows down the production of oil, lowering supply and increasing prices. President Bush has temporarily eliminated these environmentally based restrictions in an effort to reduce gas prices, but the positive effect on prices may be far lower than the negative effect on the environment.

An additional reason alluded to is that new environmental laws by the United States required a more intensive refinement process, which slows down the production of oil, lowering supply and increasing prices. President Bush has temporarily eliminated these environmentally based restrictions in an effort to reduce gas prices, but the positive effect on prices may be far lower than the negative effect on the environment.