Friday, May 05, 2006

Factors in Rising Gas Prices

In my first post about rising gas prices, I covered the way the price of gasoline is determined, and what factors contribute to the cost of one gallon of gas. In this post, I’ll examine four factors that have contributed to the sudden meteoric rise in that price: supply and demand, vertical integration of the oil market and price gouging, previous stagnation of prices in the gasoline market, and government influence for the oil companies.

Both the right and the left are pointing fingers and screaming about these four issues, and so it’s important to have a strong understanding of what role each has played in this most recent crisis. At the end, I’m sure it will be clear that the all four factors contribute to the rising price, and that perhaps as a result there is no real villain in this situation. But this will set us up to look at solutions, which exist and have not been explored thoroughly.

Supply and Demand

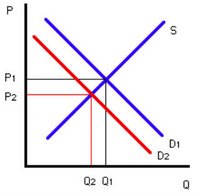

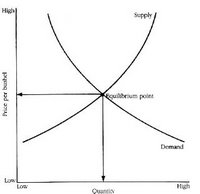

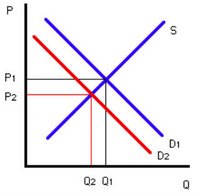

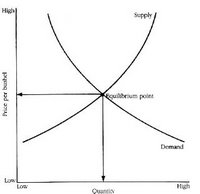

For those of you who don’t have an economics background, supply and demand refers to the two components of a transaction; supply is what is being sold, and refers to how much of any commodity or service is available at a given price, and demand refers to how many people are willing to purchase a product at any given price. Each is represented by a line on a graph showing the changing supply and demand at various prices.

Above, you can see a supply and demand curve. The point marked as the “Equilibrium point” is the price that the product will be sold at to optimize sales and profitability, theoretically. If the price is higher, the demand will decrease, and product will remain unsold. If the cost is lower, there will be more demand than there is product, leaving disgruntled customers and profits unclaimed. That’s the heart of economics.

Above, you can see a supply and demand curve. The point marked as the “Equilibrium point” is the price that the product will be sold at to optimize sales and profitability, theoretically. If the price is higher, the demand will decrease, and product will remain unsold. If the cost is lower, there will be more demand than there is product, leaving disgruntled customers and profits unclaimed. That’s the heart of economics.

The theory goes that in a truly competitive market, the price of any commodity will equilibrate at a price that will allow for all demand to be met by supply at a price the market will bear. The price will allow for natural replenishment of the resource and demand will be met in the entire market, in this case the entire world, as all countries use oil.

Increase in Demand

Now look at the graph below. Here, there is an increase in demand. An example of an increase in demand would be 3 Billion new drivers/consumers from Asia. If the price remained the same, there would be huge shortages, and demand would far exceed capacity, leaving oil companies to increase supply or raise prices.

And demand is definitely increasing. Charles Krauthammer of the Washington Post points out that China has emerged as the #2 oil consumer in the world, and that between China and India there is 8 times the population in the US. With both these countries industrializing, there will be huge demand from both China and India.

Demand is also increasing in the United States. The tendency is to believe that cars have grown smaller and more fuel efficient today, but really more people drive SUVs and trucks than ever before, meaning decreased aver gas mileage. Americans are less likely to walk today than in the past, and surveys indicate that we are liable to drive even journeys of a few blocks. In fact, TomPaine.com notes that one out of every 4 barrels of oil produced are consumed by the United States. That’s about to change!

Decrease in Supply

And while the demand for oil is increasing, the supply is decreasing, both potentially and in actuality. In actuality, new environmental initiatives have reduced the output of refineries as they adjust to new fuel standards.

What’s more, April and May are the normal time for maintenance on the refineries, and thus their output is considerably lower than other times of the year, as they gear up for the busy summer season. Add in decreases in production from Hurricanes Katrina and Rita, as well as news that Kuwait’s largest oil field, the second largest oil field in the world, is running dry, and production is down significantly.

But while these actual reductions in output are temporary, and should no longer be a factor in a matter of weeks, the potential threats to oil supplies represent a longer term and larger scale threat. Increasing tensions between the US and Iran and the conflict in Iraq, representing two of the largest oil producers in the world, are a large part of the increasing prices. As such, oil is presently selling for $75 a barrel.

"Political tensions in Iran, a refinery outage in Italy and supply disruptions in Africa (are) keeping the bulls running towards record values," said Vienna's PVM Oil Associates, predicting near-term price increases.

"The price surge (also) was supported by fund investments," PVM said, noting reports that America's biggest pension fund, the California Public Employees' Retirement System, planned to allocate as much as $1 billion into oil and other commodities by August.

The shutdown Tuesday of the 400,000 barrel a day refinery complex at Priolo in Sicily also raised the floor supporting prices, along with plans by Total SA to shut down its Girassol oil field later this month in an effort to prolong production from Angola's large deep-water field.

Supply and demand effects are magnified because they are factored at all stages of the process described in the first article: supply and demand determines the price of a barrel of crude, it effects the cost of refinement, it effects the cost to transport the refined crude, and it effects the prices at individual gas stations.

And again, these are natural fluctuations for the oil market, and should, in a truly competitive market, push gas prices to a point where they will curb our consumption of gas to the point where oil production will be able to supply demand throughout the world at a price which the market will bear.

Vertical Integration of the Oil Market

Most liberals reject supply and demand as only accounting for a small percentage of the price increases we are seeing today. Most of the liberal attention is focused on the concept that collusion between the large oil companies is largely responsible for the skyrocketing gas prices we are seeing today. And the liberals are not without a fair amount of evidence.

Consolidation of the Oil Market

Over the past 10+ years, the oil industry has been consolidating power in the hands a few major companies. There has been a huge consolidation of power amongst five oil companies.

While people remember the famed 7 sisters, there were also a large number of somewhat smaller oil companies that have, over the years, been swallowed up by ExxonMobil, ChevronTexaco, ConocoPhillips, BP, and Royal Dutch Shell. all statistics indicate the widening disparity between the Big 5 and the remaining small companies.

In March 2004, The Public Citizen did a report on factors effecting gasoline prices and the oil market, and the paper was obviously written from a liberal perspective. But certain facts are presented that are telling, and I have found collaboration for many statistics in other articles. For example, look at the disparity in market share for the Big 5 oil companies 1993 to 2003, just a 10 year span:

The 14.2% of global oil production from 2003 is roughly as much as all of OPEC combined. Opec only provides approximately 15% of our domestic oil needs, the rest coming from Canada, Mexico, Norway and England, and much of that oil is still refined by the oil powerhouses.

Collusion between Big 5 Oil Companies

The Public Citizen paper goes on to point out an incident in 2001 where the Federal Trade Commission determined that the oil companies withheld gas in order to drive up prices. The article indicates this concludes this could only occur if there was collusion between the companies. Additionally, the author points to the whopping $125 Billion in after-tax profits for the oil companies between Bush’s inauguration in January 2001 and April 2004 as proof of collusion between the companies.

Wow, that’s a lot of money! But you know what; it does not constitute proof of collusion between the oil companies. Sure, it’s logical that they worked together to derive a price, if you want that to be the conclusion. But nothing has proved to me yet that collusion exists, despite these exorbitant prices.

This excerpt is from a 2005 FTC report on gasoline prices and the fluctuation in prices:

One of the Report’s conclusions is that over the past 20 years, changes in the price of crude oil have led to 85 percent of the changes in the retail price of gasoline in the U.S., while other important factors have included increasing demand, supply restrictions, and federal, state, and local regulations such as “clean fuel” requirements and taxes.

“U.S. consumers are frustrated by rising gasoline prices, and they deserve to know the facts. Further, only through a hard look at the facts can officials make what likely are tough decisions and devise meaningful responses to important consumer issues,” said Chairman Deborah Platt Majoras. “The Federal Trade Commission will continue to watch closely for signs of anticompetitive or fraudulent conduct in the petroleum industry, and will take swift action against any law violation.”

It couldn’t be much clearer that they are looking for signs of collusion and at the very least are not finding clear proof of collusion between the companies. Liberals (a group I generally associate myself with) can bemoan government influence, but I tend to agree with this conclusion, that no direct collusion occurred. However, I come to this conclusion because I believe no collusion was necessary.

Lack of Competition in the Oil Industry

That is not to say that everything is kosher here. There is clearly a lack of competition in this market. The competition that should drive companies to arrive at the best price, because otherwise another company will undercut them and take their market share, doesn’t exist here, leaving the companies free to set a price that is exorbitant, because the other companies have no incentive to undercut them. This 2004 report says exactly that.

In testimony before the Senate Judiciary Committee, analysts said mergers within the industry had left the market in the hands of relatively few major companies that now have little incentive to produce surplus gasoline.

"The problem is not a conspiracy, but the rational action of large companies with market power," pointed out Mark Cooper, director of research for the American Consumer Federation.

Cooper continued: "With weak competitive market forces, individual companies have flexibility for strategic actions that raise prices and profits. Individual companies can let supplies become tight in their area and keep stocks low since there are few competitors who might counter this strategy."

Look at the chart to your right. The chart is meant to support the Big Oil companies by showing that they make a lower profit margin than all the other big companies out there. But what it also shows us is that the oil companies are making larger profits than any of the other companies. And what’s more, those numbers are from 2004; This past quarters earnings, just released last month, nearly meet the annual profits for these companies.

Further, the profit margins alluded tois not necessarily all encompassing. The assumption is that the chart is looking at the markup from the purchased refined gasoline or oil to the consumer purchase. But lack of competition in this market means that the Big 5 Oil companies not only receive the markup to the consumer, but often the markup from refinement and even the markup from crude extraction and production as well.

And herein lays the problem. In a competitive market, these companies would push to lower prices by decreasing their markup in various stages of oil production, making their oil more price-attractive to the consumer and grabbing market share from their competitors. But in this market, collusion is not necessary because competition doesn’t exist, and the parties know the market well enough to keep prices pretty much in line without collusion.

Stagnation of Prices in the Gasoline Market

The Seattle Times compares purchasing a gallon of gas to a gallon of milk, pointing out that both were about the same price 20 years ago, and have risen to be the same price again, 20 years later. Yes, the price of milk has gradually increased over all these years, whereas gas has jumped up in price. But the article indicates these increases are overdue, and the only question is why people react to these price increases.

Why, in short, are we as consumers far more sensitive to the price of gasoline than practically anything else we buy?

The reasons have a lot to do with our perceptions as consumers, say experts on buying behavior. Because gasoline is sold separately from other goods and goes through big, unpredictable price swings, each increase stands out and reinforces our sense that current prices are unfair and unprecedented.

"Gasoline is a unique product," said David Stewart, who teaches marketing at the University of Southern California's Marshall School of Business. "You have to go to a specific place, a service station, to fill up, so it becomes an event that really stands out relative to other kinds of shopping."

The article points to the years of cheaper gas, and the drastic rise in prices, giving people an unrealistic view of the recent rise in prices. And this is undoubtedly true, to some extent. People have made plans, business plans and budgets based on expectations of the cost of gasoline. With prices rising so rapidly, the American public can’t help but be shocked as their expectations are thrown out the window.

In Reality…

In reality, however, we have seen prices rising over the past 5 years. Since January 2001, oil prices have increased 240%. The past 5 years have seen massive increases in the number of SUVs and light trucks on the road, and presently more than 2.5 trillion miles are driven in the United States each year. Today we drive almost twice as much as we did in 1980.

The US consumes of 20 Million barrels of oil per day, of which 45% is used for motor gasoline. 178 Million gallons of gasoline are consumed by American drivers every single day, a number that has been rising over 2.5% every single year.

As such, to attribute the recent jumps in price to market adjustment, the market making corrections for past price stability, would appear to be an incorrect evaluation of the evens leading up to this price increase.

Indeed, the chart we see here indicates clearly that the price has fluctuated throughout the past 55 years based on supply and demand. To me, this is clearly a case where the increased prices are a reaction to present conditions as opposed a reaction to past conditions, and thus I disagree with the notion of the recent price increases being the result of a correction for past stagnation in the oil industry.

Government Influence for the Oil Companies

Liberals also point to the amount of money spent on government lobbying, as well as the close ties of Bush and Cheney to the oil industry, as clear proof that the oil industry is gaining favors from the US government. The oil industry pays over $50 Million every year to lobby Congress and the White House, which, if it has resulted in easier conditions for the companies, is money well spent.

This issue I’m going to hold off on, for the most part, until the next post in the series. But suffice it to say that while I have seen some favoritism towards the oil industry, I do not believe that the government, under any president, would have been able to affect anti-monopolistic legislation fast enough to prevent the lack of competition in the market that has occurred, and I don’t believe the policies implemented by this government have purposefully been used to try to drive the price up.

That being said, I’m not sure that the government has done all it can to keep prices low, and that there is some favoritism from the Bush/Cheney White House towards the oil industry. It is not, however, enough favoritism to create this huge fluctuation we have seen recently in prices.

Conclusions

After researching the four causes indicated by both the right and the left, I believe that supply and demand is the largest determiner in the huge price increases we’ve seen in gasoline over the past few months. However, the effects of decreasing supply and increasing demand have been exacerbated by the lack of competition in the market and the unwillingness of the Bush Administration to enact measures that would maintain lower fuel prices.

I hope to follow this up in a few days with a post on how to combat rising prices. It will focus on what the Bush Administration has already done to try to keep prices low, what has been done in other countries towards the same end, measures that are being proposed by groups from both the right and the left, and my own suggestions for measures that would improve the present crisis.

I will finish up with a look at the effects that rising oil prices are having on society, both on a consumer and a business level. I will also examine some of the positive effects of rising oil prices, and I’ll focus on some of the comments I’ve received throughout the series.

technorati tags: Oil, Price, Prices, Gas, Inflation, Supply, Demand, Price, China, Barrel, Vertical, Integration, Collusion, Gouging, OPEC, ExxonMobil, ChevronTexaco, ConocoPhillips, BP, Royal Dutch Shell, Iran, Iraq, Canada, Mexico, England, Government, Bush, Bush Administration

Posted by Scottage at 3:06 AM /

| |

Above, you can see a supply and demand curve. The point marked as the “Equilibrium point” is the price that the product will be sold at to optimize sales and profitability, theoretically. If the price is higher, the demand will decrease, and product will remain unsold. If the cost is lower, there will be more demand than there is product, leaving disgruntled customers and profits unclaimed. That’s the heart of economics.

Above, you can see a supply and demand curve. The point marked as the “Equilibrium point” is the price that the product will be sold at to optimize sales and profitability, theoretically. If the price is higher, the demand will decrease, and product will remain unsold. If the cost is lower, there will be more demand than there is product, leaving disgruntled customers and profits unclaimed. That’s the heart of economics.